All Insights

Venture

From Salaryman to Startup: Japan's Entrepreneurial Revolution

Jonathan Yeh

5/27/2025

8 minutes

Japan is undergoing a subtle yet profound transformation – one that signals a shift in how a new generation views risk, ambition, and the very meaning of work. For decades, Japan’s economy was synonymous with lifetime employment, hierarchical corporate structures, and societal norms that prioritized the commitment to work stability. But today, a quiet revolution is underway. Across Tokyo and beyond, young Japanese professionals are choosing the uncertainty of entrepreneurship over the predictability of corporate life. This change is more than anecdotal; it is part of a broader evolution of mindset, infrastructure, and opportunity that will redefine Japan’s role in global innovation.

The Paradox of Innovation Without Entrepreneurship

Japan has long been heralded as a technological powerhouse. It ranks among the global leaders in R&D intensity, with annual expenditure consistently among the highest in the world. According to the OECD, Japan's R&D investment accounts for over 3% of GDP – placing it as one of the most research-intensive economies globally [1]. It’s universities and corporations have produced Nobel Prize winners, scientific breakthroughs, and globally recognized brands. However, Japan’s challenge has never been a lack of scientific talent or technological sophistication. The challenge has been the rate of converting foundational invention into scalable innovations with global reach.

For many years, Japan’s scientific inventions have remained concentrated within academia and large corporations, with limited translation into the startup space and new venture activity has developed at a more measured pace than in other global hubs. Quietly though, a solid foundation has been laid through steady R&D investment, scientific excellence, and, presently, multi-faceted government stimulation. Today, policy reforms, private capital, and shifting social norms are converging to close that innovation gap. Foundational strengths are converging with a cultural and structural shift that is propelling Japanese entrepreneurship into the mainstream. Startup investments in Japan have surged nearly tenfold between 2013 and 2022. Even amid global downturns in 2023 and 2024, Japan’s startup investment declined only modestly – underscoring growing resilience and institutional confidence [5].

Cracks in the Corporate Mold

The roots of change in this new generation lie in a growing disillusionment with corporate life. A stagnant wage environment, rigid hierarchies, and limited opportunities for personal growth compared to other countries have diminished the allure of traditional “salaryman” careers. For younger generations, autonomy, creativity, and purpose are beginning to outweigh job security. As noted by the Financial Times, the “salaryman” identity—once seen as a symbol of middle-class respectability—is rapidly losing cultural relevance among younger Japanese workers, who are questioning the logic of long-term loyalty to inflexible institutions [8].

A survey by METI (Japanese Ministry of Economy, Trade and Industry) in 2023 showed that approximately 45% of university students are actively considering employment at startups or venture companies and significantly more professionals under age 34 are moving from large corporations to startups in search of meaning and flexibility [3]. This trend is reinforced by Techstars' observation that younger Japanese founders are increasingly rejecting conventional career paths in favor of high-risk, high-reward startup ventures [4].

These shifts represent not just a change in employment preference but a deeper cultural recalibration. The East Asia Forum notes that entrepreneurship is becoming a vehicle for individual empowerment and societal contribution, offering an alternative to career stagnation in legacy sectors [6]. Similarly, the Carnegie Endowment emphasizes that today’s entrepreneurs in Japan are often mission-driven, motivated not only by commercial success but by a desire to solve social or scientific problems with real-world impact [7].

Entrepreneurship is increasingly seen as a path to personal agency and creative fulfillment. Rather than adhering to rigid corporate hierarchies, more young professionals are gravitating toward environments where they can shape their own trajectory and build something of their own. This shift reflects more than economic pragmatism. It reflects a generational desire for autonomy, creative expression, and societal impact. Many Gen Z and millennial professionals want to shape their careers, and the world, on their own terms.

Academia Fuels the Movement

Japan’s leading universities are playing a growing role in this transformation. Institutions like the Universities of Tokyo, Keio, Kyoto, and Kyushu are ramping up their entrepreneurship programs, establishing innovation hubs, and promoting spinout companies. Programs like EDGE-NEXT, supported by the government, are training researchers in IP strategy, business development, and startup formation. Similarly, the Kyusoukai Fund at Kyushu University, a privately financed initiative that was created by alumni and supporters to accelerate the transition from academic discovery to societal application, provides grants and mentorship to help researchers explore entrepreneurial pathways while still within the university setting. Notably, these efforts are having impact: METI data shows a consistent rise in academic startup formation: over 3,700 university-affiliated ventures had launched by 2022, up from just 54 in 1989 [3].

These startups are particularly prominent in deep-tech domains, where Japan has unique strengths. Japan’s expertise in advanced science and engineering, such as robotics and regenerative medicine, gives it a comparative edge in deep-tech entrepreneurship. Startups developing complex technologies, from the life sciences to next-generation batteries, are not only aligned with national needs like decarbonization and aging demographics, but are also highly defensible from an IP standpoint.

To support these ventures, government initiatives such as the Deep Tech Startup Support Program and the AMED Pharmaceutical Ecosystem Strengthening Program have emerged as critical pillars. These offer up meaningful non-dilutive milestone-based funding, targeting sectors like regenerative medicine, advanced therapeutics, and biomanufacturing [2]. These are designed not only to de-risk early-stage ventures but also to ensure long-term value creation that aligns public health priorities with investor returns.

Over 3,700 university-affiliated ventures were launched in Japan by 2022, up from just 54 in 1989 [3].

Shifting Capital and Infrastructure

Japan’s venture capital infrastructure is also evolving. VC capacity hit a record $9.7 billion in 2023, up 10% from the prior year [5]. While still modest compared to markets like the U.S., the trend signals growing confidence among investors. Japan’s VC environment has reported a 60% increase in the number of active venture capital firms since 2015, with a notable rise in sector-specialized and university-affiliated funds [2]. In parallel, corporate venture capital (CVC) participation now accounts for nearly 30% of startup investments, further anchoring the ecosystem in long-term institutional support [2].

This shift is supported by bold government policy. Prime Minister Kishida declared 2022 the “first year of startups,” unveiling a five-year plan to boost startup investment tenfold, foster 100 unicorns, and expand international reach [2]. Programs such as J-Startup, J-StarX, and the Global Acceleration Hub are connecting founders to global mentors, markets, and capital. Reforms to the startup visa, angel tax incentives, and employee stock option rules have also dramatically lowered the barriers to entry for entrepreneurs and investors alike [2]. Collectively, these policies are transforming Japan’s startup landscape into one that is more dynamic, globally connected, and founder-friendly.

Talent Transformation: From Passive to Proactive

In contrast to previous generations who prioritized job security and stable advancement within large corporations, today’s aspiring founders are seeking ownership of ideas, products, and their own futures. They are digitally native, internationally minded, and more willing to take risks in exchange for autonomy, impact, and personal growth. More importantly, they are driven by purpose. Social ventures are gaining traction, tackling issues from climate adaptation to global healthcare challenges. Entrepreneurship is no longer just seen purely through the lens of financial gain but also about making a meaningful contribution to society.

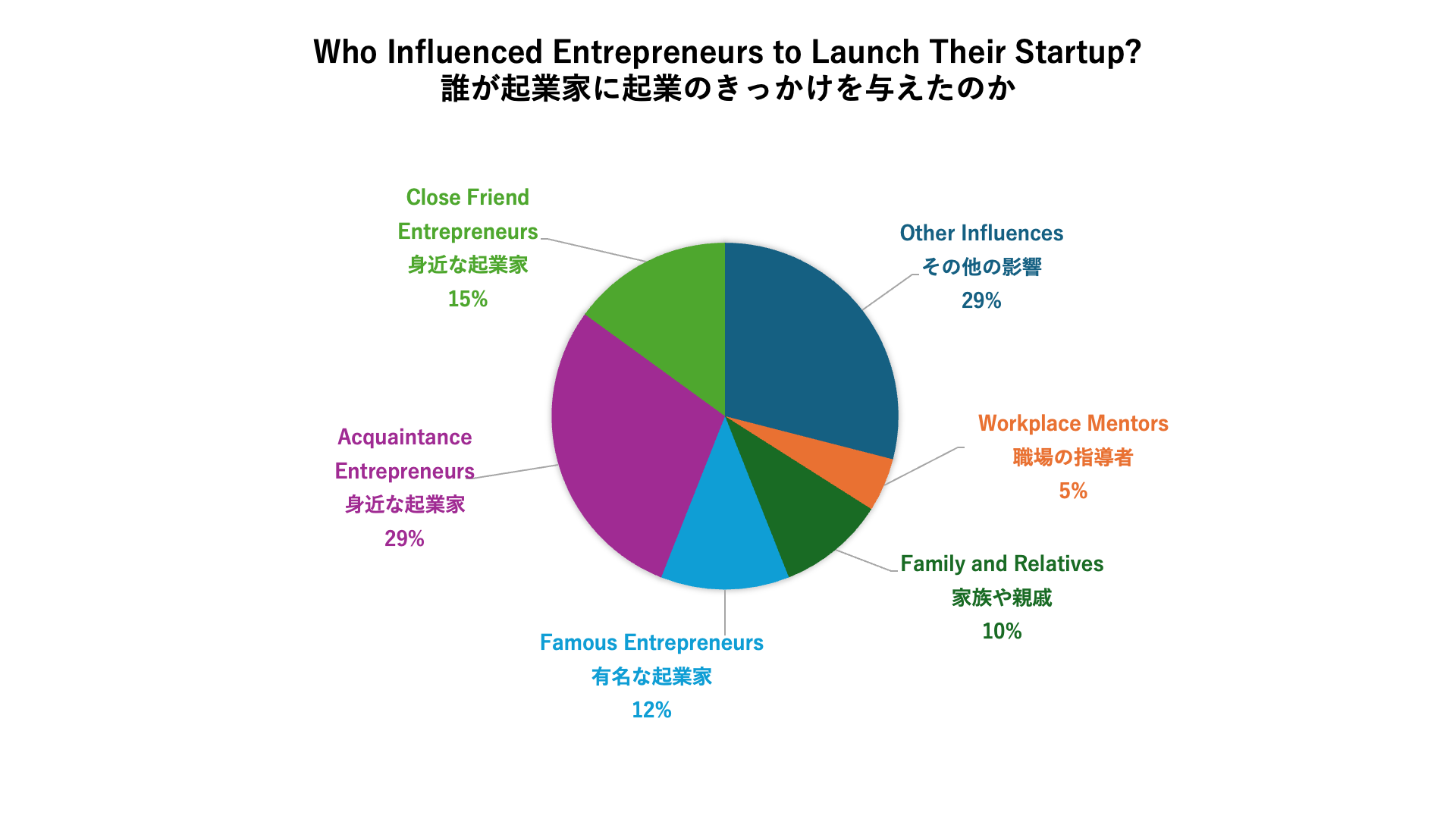

This shift is being driven by a generation that has grown up immersed in technology, exposed to international models of innovation, and encouraged to pursue non-linear career paths. According to a 2023 METI-Penmark survey, 58% of new entrepreneurs say their motivation came from other entrepreneurs around them or well-known founders [3]. This illustrates a powerful network effect: entrepreneurial energy begets more entrepreneurial energy. This aligns with data from the Tokyo Start-Up Ecosystem Report, which emphasizes the importance of soft infrastructure, such as mindset, mentorship, and peer learning [10].

Recognizing this societal shift, Saisei Ventures has launched its Executive Fellows Program, which pairs CEOs of Japanese biotech startups with seasoned global leaders. We see this as more than pure mentorship – it’s a strategy to simulate the dense, high-collision networks of Silicon Valley or Kendall Square. By embedding international insight and operational expertise into early-stage companies, the program aims to compress learning curves and accelerate growth. Executive Fellows bring decades of experience in company formation, clinical development, business development, fund raising and regulatory strategy. By embedding them into our startups, we’re helping founders improve operational execution, sharpen decision-making, and navigate global partnerships with greater confidence.

We see this as a key competitive advantage. While Japanese biotech founders are often young and motivated, reflecting the changing domestic demographics, they may lack exposure to the lived experience of building and growing global companies. The Executive Fellows Program compresses learning curves, brings global best practices into our portfolio companies, and increases the probability of success.

Over time, we believe this will catalyze a broader flywheel: today’s founders becoming tomorrow’s mentors and investors, further accelerating the pace of entrepreneurship in Japan. Thus, from a culture of passive employees navigating rigid corporate tracks, a new generation of proactive and purpose-driven leaders is emerging, prepared to lead Japan into its entrepreneurial future.

Toward a National Startup Identity

Tokyo is still Japan’s primary startup hub, with the majority of VC activity concentrated there. According to a 2021 report by the Tokyo Metropolitan Government and the World Bank, Tokyo accounted for nearly 80% of all startup financing at the time thereby illustrating the capital’s dominant role in shaping Japan’s innovation economy [10].

However, regional cities like Kyoto, Kyushu, and Okinawa are stepping up. They are leveraging local universities, investing in infrastructure, and promoting entrepreneurship as a response to labor shortages and demographic decline [9]. For example, Kyoto, rooted in centuries of scholarship and craftsmanship, is now applying that tradition to deep-tech entrepreneurship and has become a global epicenter of scientific excellence, especially in the field of regenerative medicine.

In 2006, Dr. Shinya Yamanaka of Kyoto University made history with the discovery of induced pluripotent stem cells (iPSCs), which was a breakthrough that redefined the landscape of cell therapy and earned him the Nobel Prize in Physiology or Medicine in 2012 [11]. This discovery positioned Kyoto not only as a leader in stem cell science but also as a magnet for researchers and entrepreneurs working to translate this platform into transformative therapies.

Building on this legacy, Kyoto has developed a deep expertise in stem cell biology, combined with its growing infrastructure for translational research, making it a promising region for next-generation biotechnologies. Leveraging our unique expertise, Saisei Ventures has created multiple companies that reflect this regenerative medicine leadership, most notably, Kenai Therapeutics, developing iPSC-derived cell therapies for neurological diseases, Senno Therapeutics, advancing iPSC platforms for liver disease, and Lunar Therapeutics, leveraging unique iPSC approaches to cure metabolic diseases.

As another example, Kyushu is emerging as a powerful center for life science innovation, driven in large part by the growing prominence of Kyushu University. The university has recently been recognized as a core institution for clinical and translational research, a designation that affirms its central role in bridging basic science with real-world medical applications. The university’s Center for Clinical and Translational Research (CCTR) serves as a central facility dedicated to developing new treatments and diagnostic methods. It supports the practical application of medical "seeds" by providing comprehensive assistance ranging from patenting research achievements to securing R&D funds, complying with pharmaceutical regulations, and designing and conducting physician-led clinical trials.

Finally, Okinawa is increasingly gaining attention as a frontier for scientific entrepreneurship thanks to the Okinawa Institute of Science and Technology (OIST). OIST is globally unique—an international, English-speaking graduate university with world-class research in neuroscience, physics, environmental science, and computational biology. Its dynamic OIST Innovation supports commercialization and startup formation from basic research. Through seed grants, incubator programs, and international networks, OIST is creating an entrepreneurial launchpad that stands out not just in Japan, but across Asia.

Looking Ahead: Redefining Success

The rise of entrepreneurship in Japan is more than a trend – it is a cultural recalibration. It challenges long-held assumptions about work, risk, and reward. It embraces experimentation over hierarchy, impact over stability, and creativity over conformity.

The 21st century is shaping up to belong to the startup founder. Japan’s future will depend not just on what it invents in the lab, but how it empowers its people to turn those inventions into innovations. For the first time in a generation, entrepreneurship in Japan is not the exception – it is becoming an aspiration.

References

- OECD. R&D spending growth slows in OECD, surges in China; government support for energy and defence R&D rises sharply. March 2025.

https://www.oecd.org/en/data/insights/statistical-releases/2025/ - METI. Japan Startup Ecosystem Report. June 2024. https://www.meti.go.jp/policy/newbusiness/global_promotion.pdf

- METI / Penmark. Entrepreneurship in Young Generation. 2023.

- Techstars. Should Japan Be on Your Radar as a Founder?https://www.techstars.com/blog/pov/should-japan-be-on-your-radar-as-a-founder

- Nikkei Asia. VCs’ Funding Capacity for Japan Startups Soars to Record $9.7bn.https://asia.nikkei.com/Business/Startups/VCs-funding-capacity-for-Japan-startups-soars-to-record-9.7bn

- East Asia Forum. Entrepreneurship Can Power Japan’s Economic Revival.https://eastasiaforum.org/2024/02/06/entrepreneurship-can-power-japans-economic-revival/

- Carnegie Endowment. Ready for Prime Time: Japan’s Maturing Startup Ecosystem.https://carnegieendowment.org/research/2022/08/ready-for-prime-time-japans-maturing-startup-ecosystem?lang=en

- Financial Times. Japan’s Salarymen Are Losing Their Appeal.https://www.ft.com/content/a3c4b789-d40d-4f50-a0fb-8f8b9d76340a

- World Economic Forum. How Japan Is Championing a Regional Startup Economy.https://www.weforum.org/stories/2025/02/how-japan-is-championing-a-regional-startup-economy/

- Tokyo Metropolitan Government & World Bank. Tokyo Start-Up Ecosystem Report. 2021. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099206112132137304/idu0f69350a80c2ebf4f5b0bc0b030e8ac8b4f66

Share